Semi monthly payroll calculator

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. On a semimonthly schedule the employees gross pay per paycheck would be around 229167.

How To Generate Weekly Dates From Bi Weekly Pay Period In Excel Super User

In a pay period with 16 days the daily rate would be 125.

. Examples of pay periods are. A semi-monthly gross pay of 2000 equates to a daily rate of 13333 in a pay period with 15 days. In a pay period with 16 days the daily rate would be 125.

Multiply 188 by a stated wage of 20 and you get 3760. Just enter your starting point and destination to find out the cost of your trip. Ad Payroll So Easy You Can Set It Up Run It Yourself.

In a 15-day pay period a semi-monthly gross pay of 2000 amounts to a daily. Free Unbiased Reviews Top Picks. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

So now we simply need to divide the annual gross income by the number of pay periods. Usually a monthly payment frequency is used for salary employees but hourly employees can be paid monthly as well. Computes federal and state tax withholding for.

Get Started With ADP Payroll. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. Pay Calculations To Determine Semi-Monthly Gross Pay.

Compare the Best Now. Simply enter a wage select its periodic term from the pull-down menu enter the number of hours per week the wage is based on and click on the Convert Wage button. A pay period is a recurring length of time over which employee time is recorded and paid.

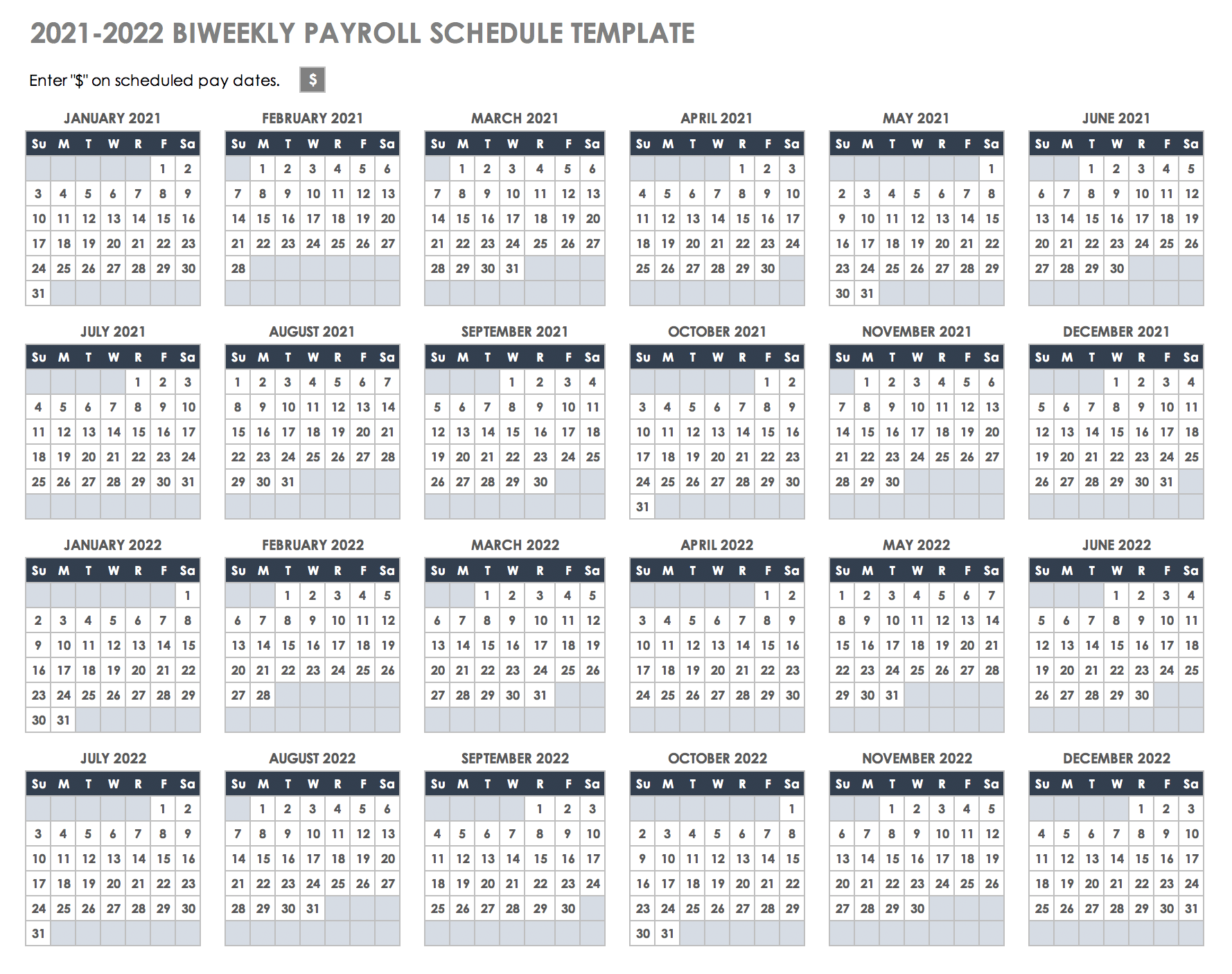

A semi-monthly gross pay of 2000. Ad Compare This Years Top 5 Free Payroll Software. 2020 Biweekly Payroll Calendar Calculator.

Multiply the result in Step 1. 2022 Semimonthly Payroll Calendar This calendar applies to all salary employees. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

Ad Process Payroll Faster Easier With ADP Payroll. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. You can use the calculator to compare your salaries between 2017 and 2022.

All Services Backed by Tax Guarantee. If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up with. Weekly bi-weekly semi-monthly and monthly.

Federal income tax rates range from 10 up to a. Free Unbiased Reviews Top Picks. Divide the actual numbers of hours worked by number of available hours in the pay cycle.

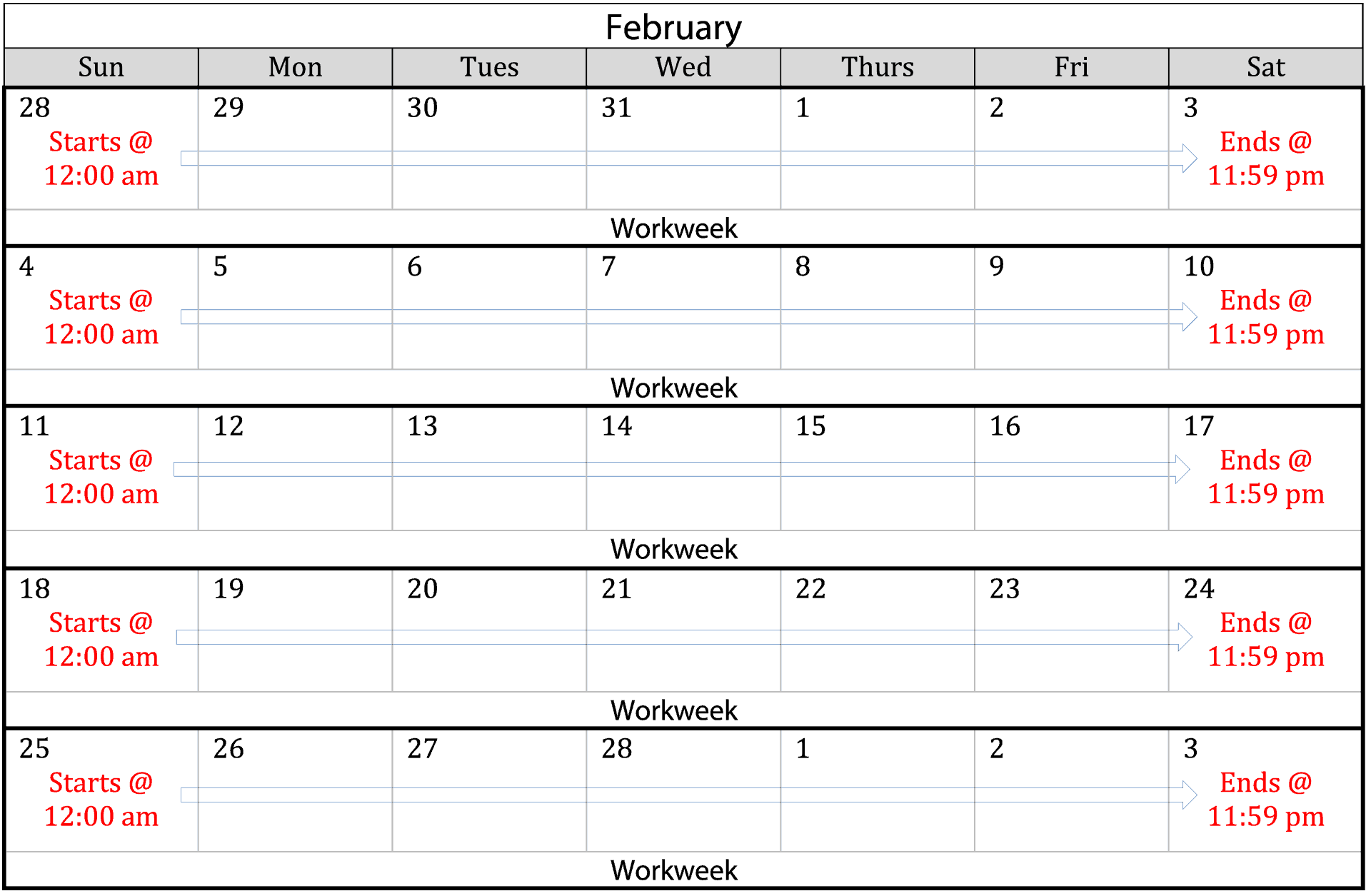

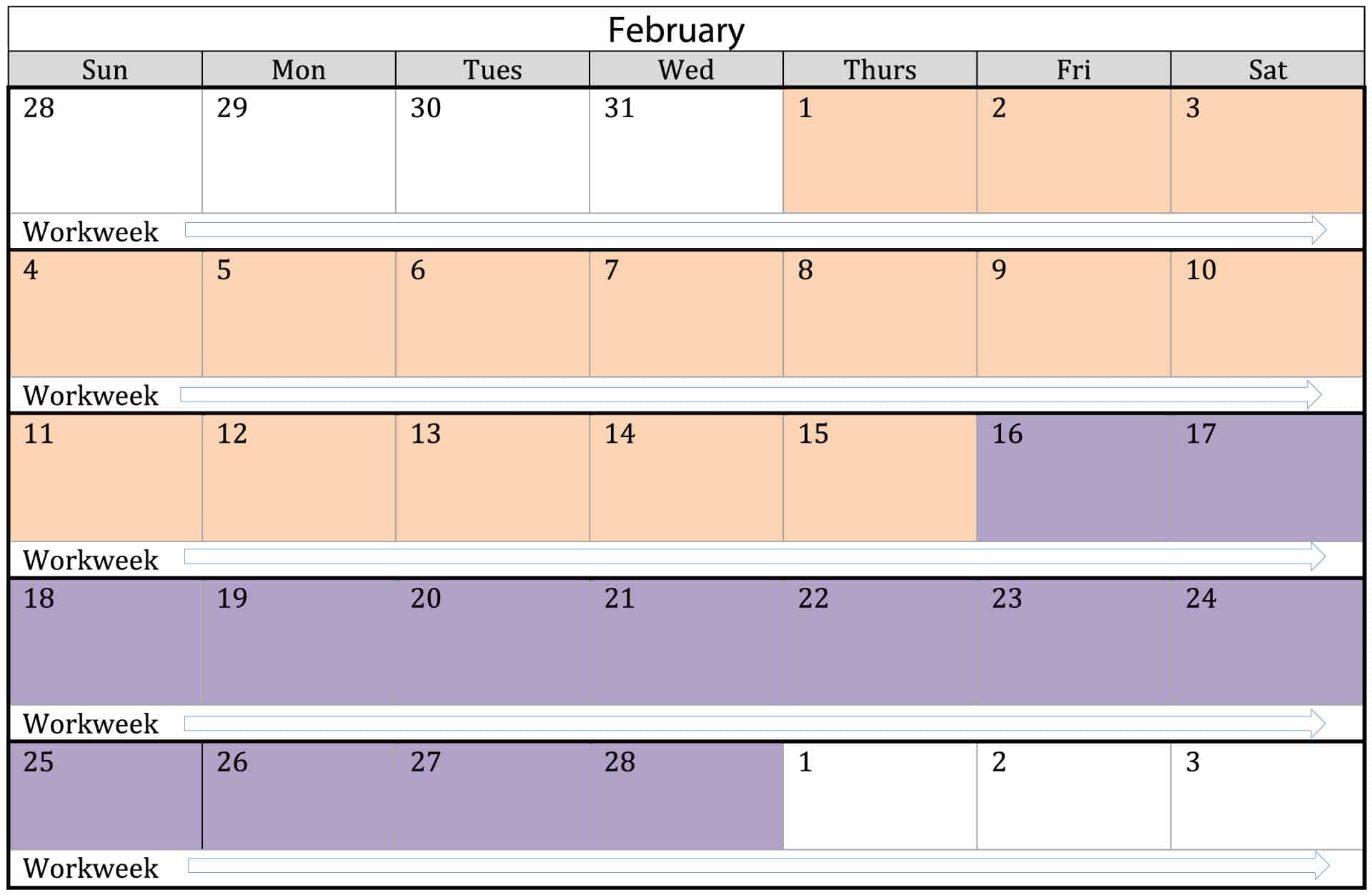

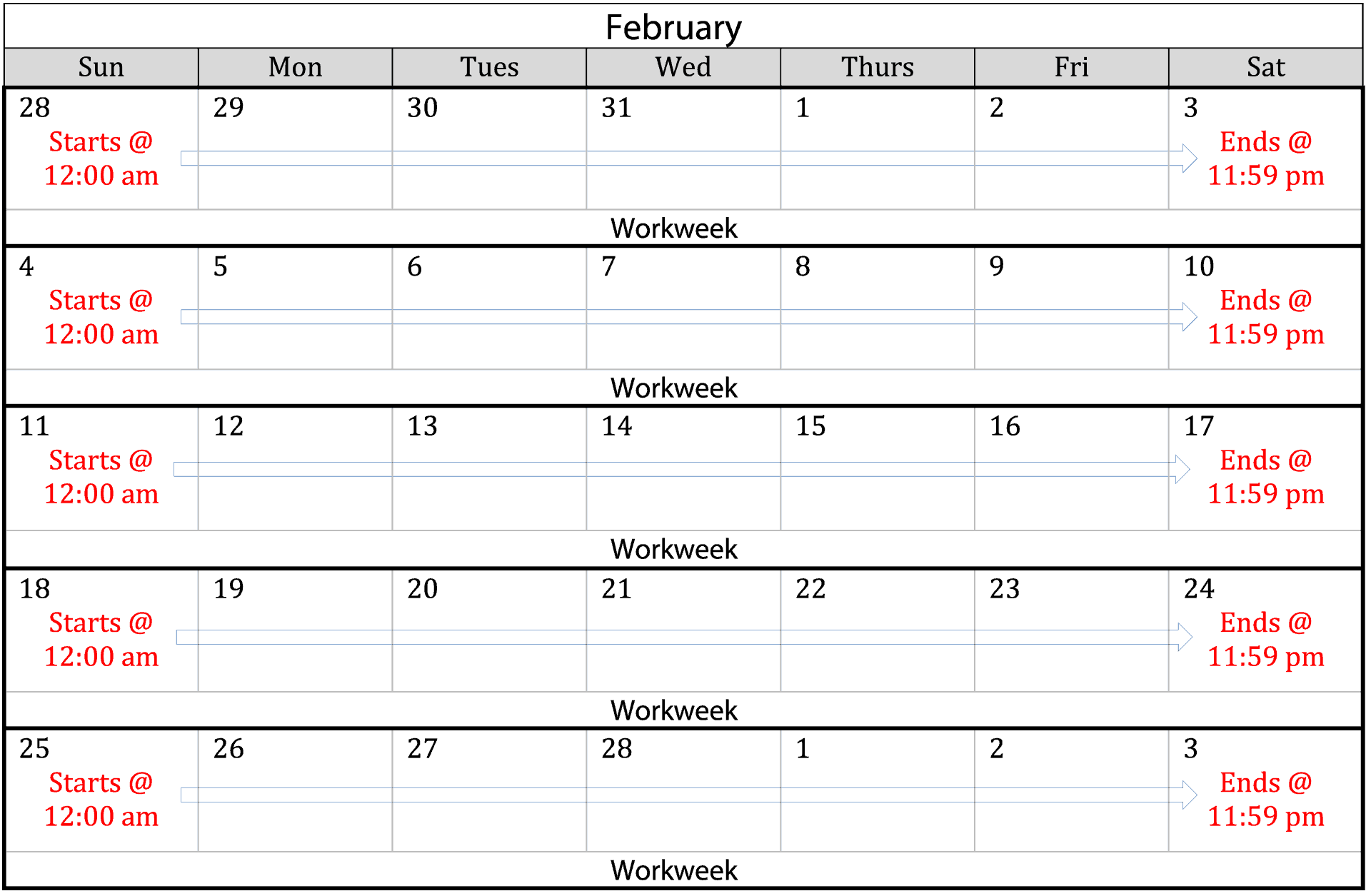

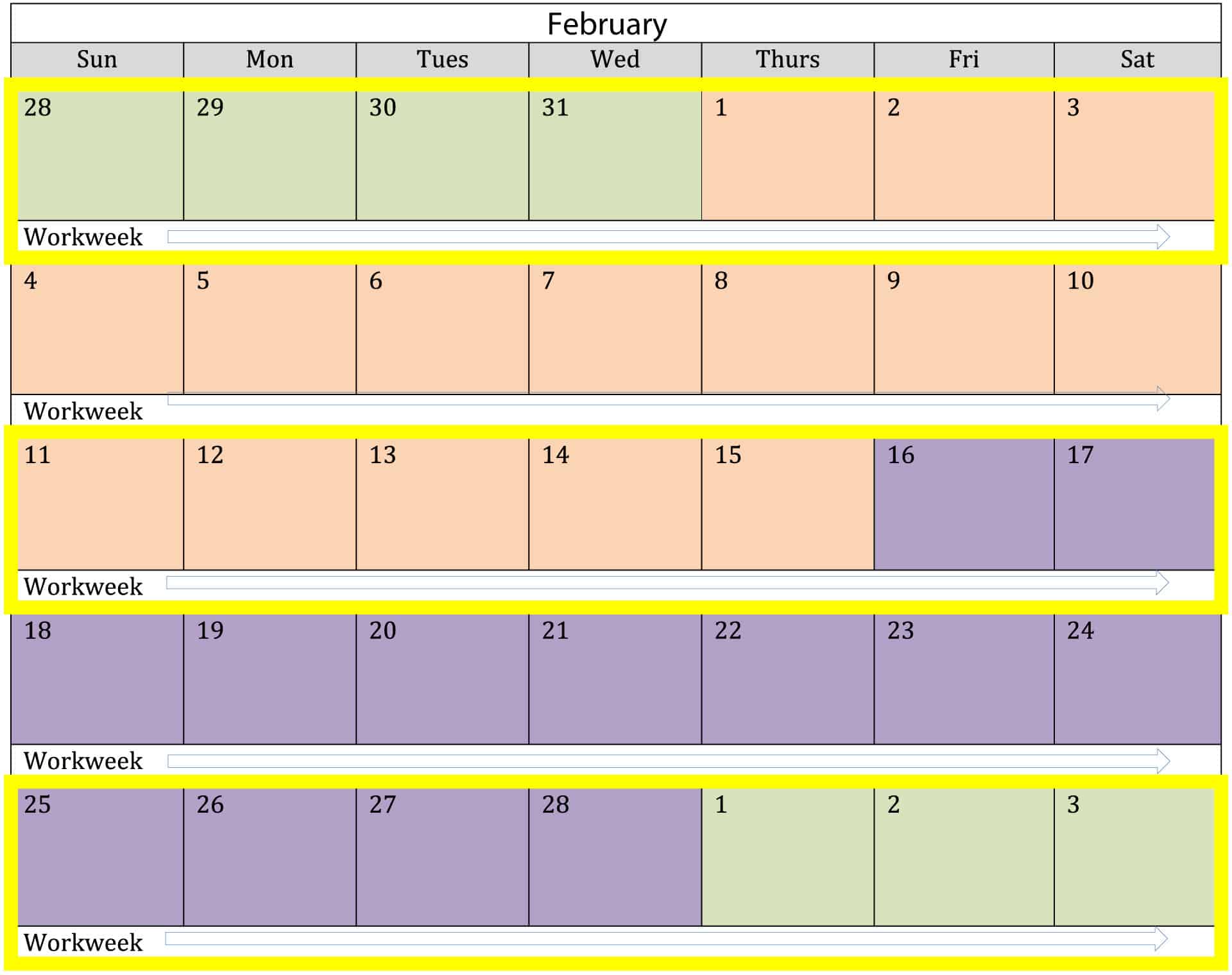

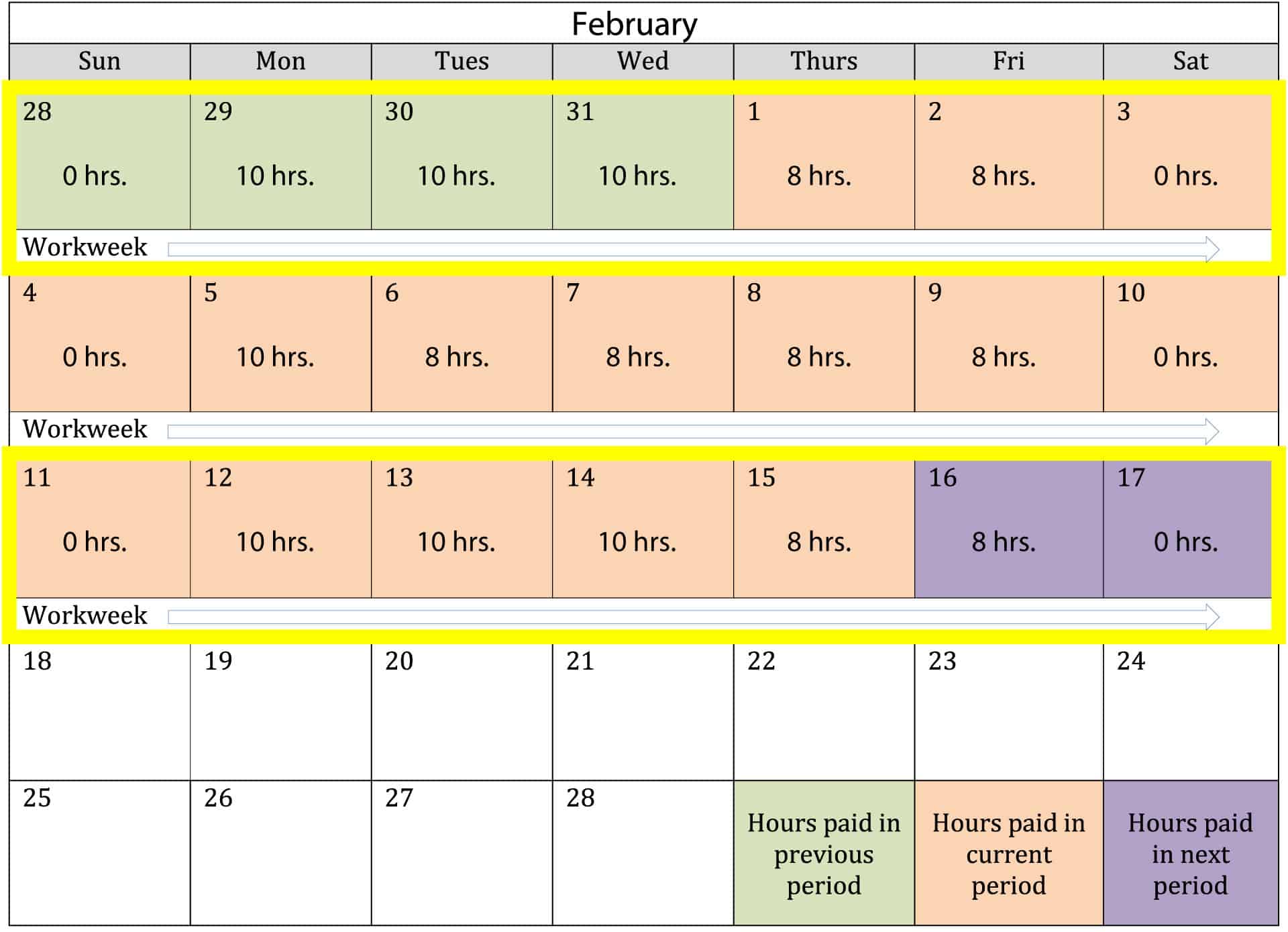

Divide the semi-monthly payroll period into workweeks determined by your employer. Weekly bi-weekly semi-monthly and monthly. Tentative dates Subject to change based upon CCS Holiday closing dates.

For the second workweek add the. Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Calculate your journey on E-470 using our interactive toll rate calculator.

Content updated daily for semi monthly payroll calculator. Paid a flat rate. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Semi-Monthly A semi-monthly payment frequency results in 24 total. Enter the dollar amount. On a biweekly schedule the employees gross pay per paycheck would be.

Get Started With ADP Payroll. Examples of payment frequencies include biweekly semi-monthly or monthly. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Process Payroll Faster Easier With ADP Payroll. For example if you earn 2000week your annual income is calculated by. Add the hours worked for the first workweek of the payroll period.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. The calculator is updated with the tax rates of all Canadian provinces and. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Employers can use it to calculate net pay and figure out how. Ad The New Year is the Best Time to Switch to a New Payroll Provider.

Divide a full pay periods gross semi-monthly compensation by the number of calendar days in that pay period. Ad Compare This Years Top 5 Free Payroll Software.

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Pros And Cons Biweekly Vs Semimonthly Payroll

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

Free 10 Monthly Timesheet Calculators In Google Docs Pages Ms Word Pdf

Payroll Calculator Free Employee Payroll Template For Excel

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Paycheck Calculator Take Home Pay Calculator

Free 9 Sample Biweekly Timesheet Calculators In Ms Word Excel Pdf

What Payroll Schedule Makes Sense For Your Business Guide When I Work

Elaws Flsa Overtime Calculator Advisor

Calculation Of Federal Employment Taxes Payroll Services

15 Free Payroll Templates Smartsheet

Semi Monthly Timesheet Calculator With Overtime Calculations

How To Calculate Daily Hourly Weekly Biweekly And Yearly Salary In Excel Sheet Youtube

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Paycheck Calculator Take Home Pay Calculator