18+ Assumable mortgage

Get the Right Housing Loan for Your Needs. Search results are sorted by a combination of factors to give you a set of choices in response to your.

Prince Rupert Northern View January 26 By The Northern View Issuu

With an assumable USDA mortgage the buyer would simply continue making the mortgage payments under the same terms as the original homeowners mortgage.

. An assumable mortgage allows a buyer to take over or assume the sellers home loan. Ad Create Your Free Mortgage Forms Agreement in Minutes. Typically this entails a home buyer taking over the home.

Yet by December 1980 the average mortgage rate stood at. Compare Rates Get Your Quote Online Now. Dexknows - helps you find the right local businesses to meet your specific needs.

How to assume a mortgage when buying a house. An assumable mortgage allows someone to find a house they want to buy and take over the sellers existing home loan without applying for a new mortgage. First Community Bankshares Inc.

In this guide well cover everything you need to know. The buyer takes over the loans rate repayment period current principal balance. Ad Americas 1 Online Lender.

Compare Offers Side by Side with LendingTree. For Your Unique Situation. An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

An assumable mortgage is a type of mortgage program that allows you to transfer your mortgage loan to the new buyer of your house. SuperPages SM - helps you find the right local businesses to meet your specific needs. Easy Step by Step Directions.

Opens in a new Window a financial holding company is headquartered in Bluefield. What is an adjustable-rate. Search results are sorted by a combination of factors.

An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions. Ad Compare Your Best Mortgage Loans View Rates. In order words you are selling your house and the.

Create Your Own Mortgage Form in Minutes. There is generally an assumption fee updated title work and the closing attorneys fee which all totaled is usually less than 1000. An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage.

An FHA assumable mortgage requires a credit score of at least 600. Mortgages in Beckley WV. Thats about one-fourth to one-third the cost of closing a.

See reviews photos directions phone numbers and more for the best Mortgages in Thurmond WV. Assumable mortgages allow you to buy a house by taking over assuming the sellers mortgage rather than getting a new mortgage to. Mortgage insurance for life is mandatory unless you assume a loan that was created prior to this.

Thursday March 1 2012 Pan By Peace Arch News Issuu

Assumable Mortgage Real Estate Terms Interest Rate Rise Low Interest Rate

Benefits Of Buying A Home With A Va Mortgage Loan

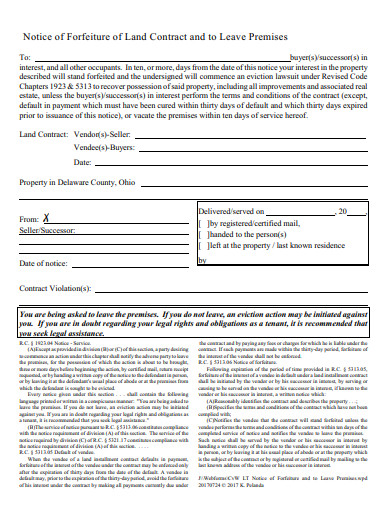

Land Contract Form 10 Examples Format Pdf Examples

Are Fha Loans Assumable In 2022 Fha Loans Fha Mortgage Lenders

Oaondfzu7h0d M

Surrey Now May 17 2011 By Glacier Community Publishing Issuu

Fha Loans Fha Mortgage Programs Hud Fha Mortgage Fha Loans Refinance Mortgage

November 23 2012 Strathmore Times Pdf Cadet Christmas And Holiday Season

Lancaster Green Ab Condos For Sale Point2

New Cheat Sheet On Types Of Mortgages Enjoy Real Estate Infographic Mortgage Cheat Sheets

Real Estate Glossary

2

Infographic Benefits Of Fha Loans Infographicbee Com Fha Loans Debt To Income Ratio Fha

Oaondfzu7h0d M

2

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha